Within the current capital markets and investment landscape, individuals and institutions both face limited options for preserving wealth with a reasonable prospect of long-term growth and interim cash flow potential. However, over time, combined returns from agricultural land appreciation and farming/ranching operations have generally achieved relatively high yields for the risk level they represent. This is largely due to the relatively stable but appreciating value of rural land and its central role in these investments.

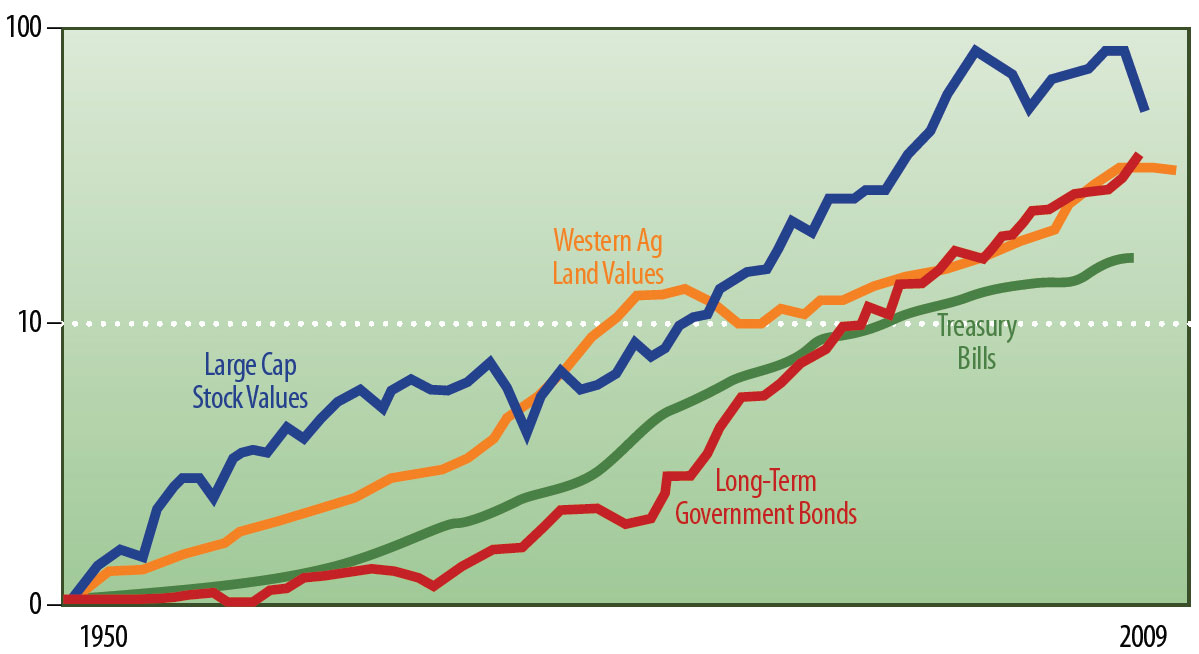

Estimated returns from 1950-2010 for farms and ranches in the 17 western U.S. states (including land appreciation) range from 7% to 13%, with an average of 9.1%. During this period, rural agricultural land rose in value at a compounded rate of 6.14%. With future growth at this rate, coupled with modest cash returns and favourable tax treatment, this could equate to a pre-tax equivalent return of 8-10% or greater… superior to many other common investment alternatives.

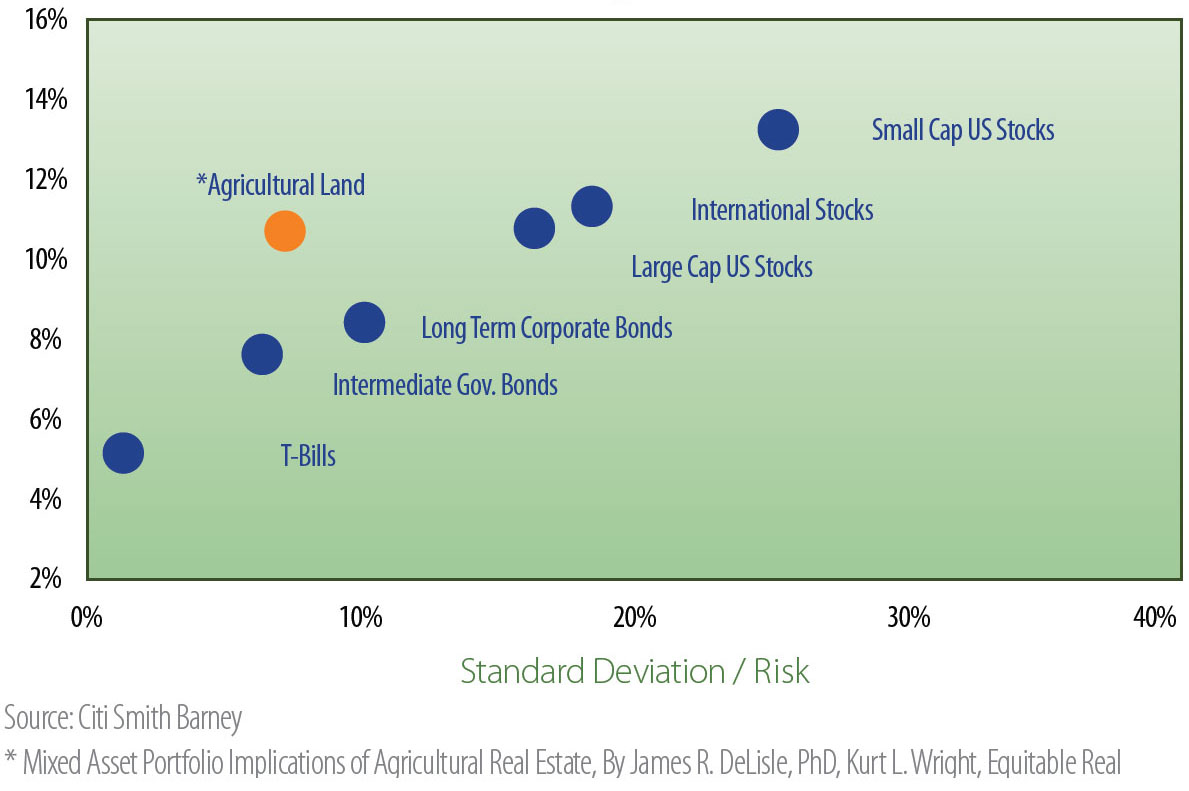

Risk and Return Results for Various Asset Classes: 1970 through 2007

As with any investment, there are inherent risks that come with investing in ranch lands. These include both price risks associated with the market and localized production risk, such as weather.

Investment Return Comparison: Large Cap Stocks, Long-Term Government Bonds, T-Bills and Western Ag Land 1950-2009

However, the overall investment risk is relatively low compared to stocks, bonds, and other asset classes due to the asset-backed nature of the opportunity and low volatility in the rural real estate market. The primary source of price risk is associated with volatility in trading value. Land typically has very low variability in its trading value, while the market value associated with ranch products may vary significantly from time to time, similar to many other investments and asset classes.